How to Passively Invest in Real Estate in Canada: A Guide

Passive real estate investing has become an increasingly popular way for Canadians to grow their wealth. By taking a hands-off approach, passive investors can earn income from real estate without the responsibilities of being a landlord. If done right, passive real estate investing can pave the road to financial freedom. This comprehensive guide will walk you through everything you need to know to start passively investing in real estate in Canada.

Key Takeaway

Passive real estate investing allows you to earn income from rental properties without having to actively manage them yourself. By hiring a property manager, you can invest in real estate and receive steady cash flow with minimal effort on your part. With careful research and planning, passive real estate investing can be an excellent hands-off way to grow your wealth over time.

What is Passive Real Estate Investing?

Passive real estate investing involves earning income from rental properties without having to deal with the day-to-day responsibilities of managing them. As a passive investor, you hire a property manager to handle tasks like:

- Finding and screening tenants

- Collecting rent

- Conducting repairs and maintenance

- Managing vendors and contractors

This frees up your time so you don’t have to deal with midnight plumbing emergencies or evicting problematic tenants. You get to sit back and collect rental income generated by your properties.

Some common passive real estate strategies include:

Rental Properties

- Single family homes

- Condos

- Multi-family apartments

- Commercial buildings

You purchase the property then contract a property management company to handle the rest.

Real Estate Investment Trusts (REITs)

REITs are companies that own and operate income-producing real estate. As a shareholder, you earn income through dividends and benefit from appreciation as properties increase in value over time.

Real Estate Crowdfunding

Invest alongside others in larger commercial or residential properties managed by experienced sponsors.

How Does Passive Real Estate Investing Work?

Passive real estate investing relies on leveraging the expertise of others to do the heavy lifting required in managing properties. Here is the basic process:

- Research and identify passive real estate investment opportunities: Conduct market research to determine which rental properties or funds match your investment goals. Analyze factors like expected returns, risks, timelines, and liquidity.

- Invest capital: Pool your money with other passive investors to purchase a property or invest in a fund. The required minimum investment varies.

- Earn returns: Sit back and collect rental income, dividends, interest payments, or proceeds from the eventual sale of the asset. You earn income with minimal day-to-day effort.

- Pay the experts: Funds and fees for services like property management are deducted from the earnings before you receive passive income.

Benefits of Passive Real Estate Investing

Passive real estate investing provides many advantages:

Hands-off Management

Avoid the responsibilities of dealing with tenants and maintenance issues. Your involvement is limited after the initial investment.

Diversification

Real estate can balance risk in an investment portfolio concentrated in stocks and bonds. Real estate prices often move separately from other asset classes.

Professionally Managed

Benefit from the real estate expertise and experience of fund managers and property management companies.

Passive Income

Earn regular cash flow in the form of dividends or rental income with minimal effort on your part.

Tax Advantages

Deduct expenses like property taxes, interest, repairs and depreciation to reduce your taxable rental income.

Potential for Appreciation

Profit from possible appreciation in property values over the long term.

Inflation Hedge

Real estate prices tend to rise with inflation, providing a hedge against eroding purchasing power.

Risks of Passive Real Estate Investing

While passive real estate investing has many advantages, it also comes with risks to consider:

Lack of Control

You have limited control over investment decisions compared to owning and managing properties yourself.

Illiquidity

It may be difficult to sell your shares of a property or fund quickly, unlike stocks which can be sold instantly.

Property Mismanagement

Poor property oversight by a incompetent or dishonest manager could reduce your returns. Proper due diligence is key.

Compressed Yields

Management fees and other expenses reduce your net rental income and overall investment returns.

Declining Property Values

A downturn in the real estate market could lead to lower rents and reduced property values, harming your returns.

Higher Investment Minimums

You may need more capital upfront to invest in funds compared to buying real estate directly.

Passive Real Estate Investment Strategies

Now that you understand the basics, let’s look at some of the most common strategies for passively investing in real estate:

Turnkey Rental Properties

A turnkey rental property comes fully renovated and tenant-ready. A property management company takes care of everything, while you simply collect rental checks every month. A few attractive features:

- Buy: Purchase an investment property from a turnkey provider who has already rehabbed the home.

- Manage: The turnkey company handles property management under a long-term contract.

- Income: You immediately begin earning monthly passive rental income.

Turnkey rentals provide new real estate investors an easy hands-off approach to earn rental income. However, costs are higher and there is less control compared to a do-it-yourself rental property.

Real Estate Investment Trusts (REITs)

A REIT is a company that owns and operates income-producing real estate. Some benefits of investing in real estate through REITs:

- Diversification: Invest in a portfolio of properties across different real estate classes like apartments, offices, retail, etc.

- Liquidity: Buy and sell shares easily like stocks, providing access to your money at any time.

- Passive Income: Earn steady dividends from rental income produced by the properties.

- Professional management: REIT managers have extensive real estate expertise.

- Low investment minimum: Provides easy access to commercial real estate with minimal capital.

REITs provide effortless access to income-producing real estate properties. Just be sure to research the REIT thoroughly before investing.

Real Estate Crowdfunding

Real estate crowdfunding pools money from multiple investors to purchase property. Key features:

- Invest in larger-scale properties like apartments normally unavailable to individual investors.

- Each deal has a sponsor who sources and manages the deal.

- Investors contribute capital while the sponsor operates the property day-to-day.

- Open to non-accredited investors with minimum investments as low as $500.

- More risky; be sure to vet the sponsor thoroughly before investing.

By pooling capital, real estate crowdfunding allows you to invest in institutional-quality real estate assets with other individual investors.

Private Lending

As a private lender, you provide financing for real estate investors in return for interest income. Some advantages:

- You earn passive income from loan interest without having to own or manage property.

- Loans are secured by the property, providing collateral if the borrower defaults.

- Higher returns possible compared to traditional fixed income investments like bonds.

- Ability to customize loan terms like duration, interest rate, etc.

Private lending allows you to leverage your capital to earn strong interest income. Make sure borrowers are qualified and thoroughly vet each deal.

How to Get Started with Passive Real Estate Investing

Follow these steps to launch your passive real estate investment endeavors:

Step 1: Set Your Investment Goals

Be clear about what you want to achieve. Important factors to consider:

- Income vs. appreciation: Do you prioritize cash flow or long-term growth?

- Investment horizon: What’s your ideal timeframe? Short term vs. decades.

- Risk tolerance: How much risk are you comfortable accepting?

- Liquidity: How accessible do you need your money to be?

- Investment amount: What’s your starting capital and contribution capacity?

With your goals defined, you can focus on options that align with your needs and desires.

Step 2: Choose a Passive Investment Strategy

Research different real estate investment vehicles and structures like REITs, crowdfunding, and turnkey rentals. Compare factors like:

- Fees: Management fees, commissions, etc

- Minimum investment amount

- Expected returns

- Liquidity terms

- Property types and geographic locations

Look for a strategy that achieves your goals while minimizing fees and risk exposure.

Step 3: Conduct Due Diligence

Thoroughly vet any sponsor, fund manager, or turnkey provider before investing your capital.

- For real estate funds or REITs, review their track record, leadership team, and fee structure.

- For turnkey providers, confirm they properly rehab properties and have a solid property management arm.

- For crowdfunding sponsors, look at their experience, portfolio, and past deal performance.

Proper due diligence reduces chances of mismanagement jeopardizing your investment.

Step 4: Start Investing

Begin deploying your capital into passive real estate investments that match your objectives. Consider starting small to test the waters.

- Diversify across multiple investments to reduce risk exposure to any single asset.

- Reinvest earnings to compound returns over time.

- Hold assets long term for appreciation while collecting rental income.

Take your time ramping up to gain experience and confidence. Patience and discipline is key.

Step 5: Automate and Optimize

Set up direct deposits so rental income flows automatically into your account. Reinvest proceeds into new opportunities.

- Refine your investment mix over time for improved diversification and returns.

- Meet with your tax advisor to maximize tax savings from your properties.

- Consider estate planning to ensure your assets transfer smoothly to heirs.

Stay organized and take steps to sustain and optimize returns from your portfolio over your lifetime.

Is Passive Real Estate Investing Right for You?

Passive real estate investing provides an appealing path to earn regular income from rental properties without being a landlord. However, it still carries risk and is not a fit for every investor. Consider whether passive real estate investing aligns with your situation:

You Want to Avoid Hands-on Management

Perfect if you prefer being hands-off after finding solid opportunities.

You Have Significant Capital to Invest

Passive real estate investing requires adequate capital to build a properly diversified portfolio.

You Have a Long-term Orientation

It takes time for rental income and appreciation to compound. Short term investors may want quicker trades.

You Are Comfortable with Some Market Risks

Real estate investing carries risks. Make sure you properly evaluate and manage risk.

If you want simple, low-effort real estate investing, passive strategies like REITs and turnkey rentals can be rewarding options. Just be sure to thoroughly research opportunities and manage risk exposure.

Key Tips for Success

Follow these tips to boost your chances of effective passive real estate investing:

- Thoroughly vet any sponsors, managers, or turnkey providers before investing.

- Diversify across different investments, property types, and markets.

- Understand all risks and fees associated with each investment.

- Invest for the long-term; don’t expect to get rich quick.

- Start small to evaluate different passive strategies before increasing investment amounts.

- Sign up for direct deposit so you automatically receive rental income.

- Reinvest profits to compound earnings.

- Meet with tax and legal advisors to maximize tax savings and ensure proper estate planning.

Frequently Asked Question

Q: What is real estate investing?

A: Real estate investing is the practice of purchasing and owning properties to generate income or to make a profit through appreciation.

Q: How can I invest in real estate in Canada?

A: There are several ways to invest in real estate in Canada. You can buy properties, invest in real estate funds, or become a passive investor by lending money to real estate projects.

Q: What is passive real estate investing?

A: Passive real estate investing refers to an investment strategy where individuals invest in real estate without actively managing the properties. They rely on professional management teams to handle the day-to-day operations.

Q: How does real estate investing in Canada affect taxes?

A: Real estate investing in Canada can have an impact on your taxes. You may be subject to capital gains tax when you sell a property, and you’ll also need to consider the tax implications of rental income or investment gains.

Q: What are some popular real estate investment options in Canada?

A: Some popular real estate investment options in Canada include residential real estate, commercial properties, and real estate exchange-traded funds (ETFs).

Q: Is real estate a good long-term investment?

A: Real estate can be a good long-term investment option as it has the potential to appreciate in value over time and generate passive income.

Q: How can I diversify my investment portfolio with real estate?

A: You can diversify your investment portfolio with real estate by allocating a portion of your investment capital to real estate assets, such as buying properties or investing in real estate funds.

Q: Can I invest in real estate without being actively involved?

A: Yes, you can become a passive real estate investor by investing in real estate funds or by lending money to real estate projects and letting professionals handle the management.

Q: What are some benefits of passive real estate investing?

A: Some benefits of passive real estate investing include not having to deal with the day-to-day management of properties, the potential for steady rental income, and the ability to diversify your investment portfolio.

Can I Use a Corporation to Passively Invest in Real Estate in Canada?

When it comes to the legalities of corporations buying houses in canada, there are some considerations to keep in mind. Corporations can indeed be used to passively invest in Canadian real estate. However, it is crucial to navigate the legal landscape and understand the regulations involved. Expert guidance is recommended to ensure compliance with local laws and maximize the benefits of utilizing a corporation for real estate investments in Canada.

Q: What are some strategies for successful real estate investing in Canada?

A: Some strategies for successful real estate investing in Canada include understanding the local market, conducting thorough research, building a reliable management team, and investing for the long term.

Conclusion

The appeal of earning steady income from real estate without being a landlord is driving the popularity of passive real estate investing. By leveraging the expertise of property managers and fund sponsors, passive investors can reap rental income and long-term equity gains through real estate without having to deal with tenants or toilets. While passive real estate investing still carries risks like any investment strategy, with proper due diligence and portfolio structuring, it can provide attractive hands-off returns for those looking to add real estate to their investment portfolio.

If you want to invest in Canadian real estate without actively managing properties, there are several options available to you. One approach is to put your money into a real estate investment trust (REIT), which allows you to invest in a diverse portfolio of real estate assets. Another option is to invest in a real estate mutual fund, which pools together money from multiple investors to buy and sell pieces of real estate. Both of these options provide a way to capitalize on the real estate market without having to become a landlord or hire a management team.

Investing in real estate can offer a good return on investment, especially in some of the hottest real estate markets in Canada. Additionally, there are tax breaks available for investment in real estate, which can further enhance your returns.

However, it is important to remember that real estate investing involves risk, and it’s important to do thorough research and work with a professional, such as a real estate agent, to navigate the market.

Overall, passive real estate investing is a way to diversify your portfolio by investing in the Canadian real estate market. By taking a passive approach, you can benefit from the potential gains of the real estate market without actively managing properties.

Canadian real estate may offer a promising opportunity for ambitious investors looking to diversify their investments and potentially earn a solid return on their money.

Key Takeaway

Passive real estate investing allows you to earn income from rental properties without having to actively manage them yourself. By hiring a property manager, you can invest in real estate and receive steady cash flow with minimal effort on your part. With careful research and planning, passive real estate investing can be an excellent hands-off way to grow your wealth over time.

Sources:

https://cmimic.ca/blog/passive-real-estate-income-ideas-for-high-net-worth-canadians/

https://www.theglobeandmail.com/investing/article-real-estate-investment-property-canada/

Ready to turn your real estate dreams into reality? Contact Richard Morrison, Vancouver’s top realtor with 20+ years of experience. As a Medallion Club member and RE/MAX Hall of Fame award winning agent, he’s the expert you need on your side. Whether buying, selling, or investing, Richard’s personalized approach and deep market insights ensure a successful transaction. Reach out to Richard today at (778) 900-2235 and make your real estate journey seamless and rewarding.

Latest Vancouver Listings

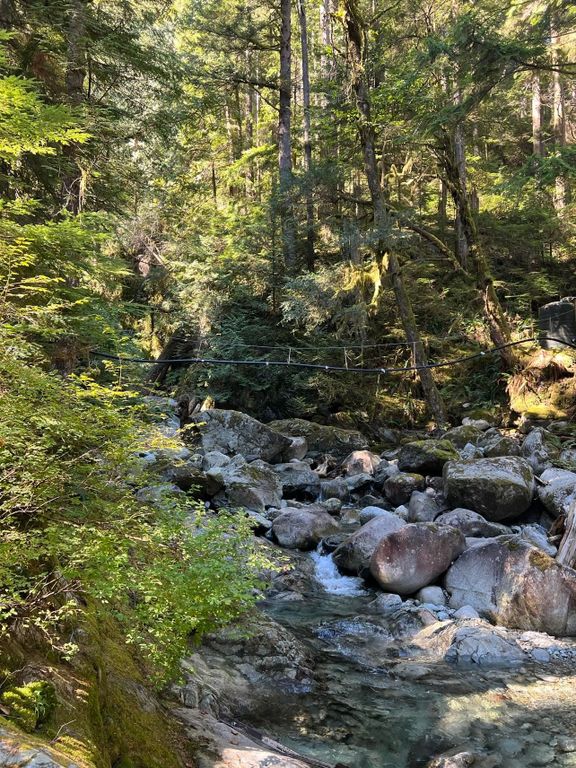

Indian Arm freehold property in desirable Coldwell Beach at an attainable...

Gorgeous waterfront property on Eagle Island, West Vancouver with...

ATTENTION BUILDERS! 3365 Square foot level lot backing onto newly revamped...

Introducing a 2-bedroom suite that defines urban elegance. With an added...

Generously sized 2 bedroom and 2 bathroom apartment in the heart of Coal...

The Conservatory Luxury air-conditioned concrete large-size condo is the...

Autograph is a signature series of just 64 homes by renowned local...

Westside architectural excellence. The latest signature address behind the...

This breath taking 2 bedrooms + 2 bathrooms ocean view unit located in...

MODE presents this 565sf east facing 1 bedroom + flex home in River...

Welcome to the Legendary Woodwards W32. An immaculate and cozy 1 bedroom 1...

Welcome to the TELUS GARDENS - award-winning LEED gold architecture by...

Fabulous 2 bedroom, 2 baths + den, NE Corner suite at UPTOWN by Concord...

Lovely family home in this prime West Bay location. Gorgeous city and...

PENTHOUSE home in Wall Centre Central Park! STUNNING panorama views of the...

'The Arc' by Concord Pacific! The best 1 bedroom floorplan in the...

MODE presents this 1406sqft East facing 3bedroom+flex+3baths home in River...

A nicely updated unit with a spacious sized bedroom and 1 bath. The...

The Pinnacle, an Iconic building in the heart of Yaletown. This unit has...

South Vancouver simply affordable one-bedroom home features spacious...

Start your search with Richard Morrison, Top Award Winning Vancouver Realtor:

Contact Richard Morrison Top Vancouver Realtor today to find a Vancouver real estate and Vancouver condos for sale. This includes eastside residences and eastside apartment for sale. Also check out West Vancouver homes for sale or maybe an West Vancouver condos for sale. If you prefer North Shore, take a look at our listings in North Vancouver homes for sale and North Vancouver condos for sale.

Vancouver East Houses

| Collingwood Downtown East Fraser Fraserview Grandview Hastings Hastings Sunrise | Killarney Knight Main Mt Pleasant Renfrew Heights Renfrew South Van Victoria |

Vancouver West Houses

| Arbutus Cambie Dunbar Kerrisdale Kitsilano McKenzie Heights Marpole Oakridge | Point Grey Quilchena SW Marine Shaughnessy South Cambie South Granville University West End |

Vancouver East Apartments

| Champlain Heights Collingwood East Downtown Fraser Grandview Woodland Hastings Hastings Sunrise Killarney Knight Condos | Main Mount Pleasant VE Renfrew Heights Renfrew South Marine South Van Strathcona Victoria VE |